The $109M Lie: Why AI for Science Funding Isn't About Discovery—It's About Data Domination

DP Technology's massive Series C signals a chilling trend: the consolidation of scientific data, not just the acceleration of breakthroughs.

Key Takeaways

- •Series C funding for AI science platforms is prioritizing proprietary data acquisition over decentralized research.

- •The true value of these companies lies in their curated datasets, creating high barriers to entry.

- •Centralization of R&D pipelines risks turning scientific breakthroughs into exclusive, high-cost IP.

- •Regulatory intervention regarding data transparency is likely within the next three years.

The $109M Lie: Why AI for Science Funding Isn't About Discovery—It's About Data Domination

Another week, another headline screaming about **AI for science** securing massive capital. DP Technology just bagged over $109.6 million in Series C funding. On the surface, this is a triumph for innovation—a clear signal that investors are betting big on artificial intelligence accelerating research across chemistry, materials science, and drug discovery. But let’s peel back the veneer of optimism, because this isn't just about faster science; it’s about **strategic capital** buying up the keys to the kingdom of proprietary knowledge. ### The Unspoken Truth: Data Moats, Not Models Everyone talks about the algorithms, the deep learning models, and the sheer computational power. They miss the central, cynical truth: In the race for **technology** dominance, the model is replicable; the curated, high-fidelity scientific dataset is not. DP Technology, like its peers, isn't just selling software; they are building an unbreachable moat around the most valuable commodity in the 21st century: clean, validated experimental data linked directly to AI-driven hypothesis generation. Who truly wins? Not the academic lab struggling to replicate results, and certainly not the small startup that can’t afford the licensing fees for these high-powered platforms. The winners are the VCs and the platform owners who now control the feedback loop between simulation and physical reality. This massive influx of **funding** isn't fueling decentralized discovery; it's centralizing the R&D pipeline under a few well-capitalized entities. This is the new frontier of corporate centralization, disguised as scientific progress. ### Why This Matters: The End of Open Science? We are witnessing the industrialization of the scientific method. When billions flow into platforms that promise to cut years off drug development, the pressure shifts from rigorous, public peer review to speed-to-market. This raises profound questions about intellectual property and access. Will the next generation of life-saving compounds be locked behind paywalls built by venture-backed platforms? History shows that when private capital takes control of infrastructure—whether railroads or information networks—access becomes dictated by profit, not public good. The promise of democratized science through AI is being quietly suffocated by the reality of proprietary data monopolies. ### Where Do We Go From Here? The Prediction Expect a regulatory and public backlash within 36 months. As these platforms mature and start announcing breakthrough results, the scrutiny over their data sourcing and IP claims will intensify. We predict that governments, particularly in the EU and US, will be forced to intervene, demanding 'data portability' or 'algorithmic transparency' for any AI platform that benefits from publicly funded research inputs or seeks to patent discoveries affecting public health. If DP Technology and its rivals fail to proactively adopt transparent licensing models, they risk becoming the next Big Tech target for antitrust action, albeit under the guise of 'scientific monopoly.' The race isn't just to discover; it’s to control the narrative of discovery.

Gallery

Frequently Asked Questions

What is DP Technology's primary focus within AI for science?

DP Technology focuses on applying artificial intelligence and machine learning to accelerate materials science and chemical discovery processes, aiming to streamline the R&D lifecycle.

How does this large funding round impact the broader technology sector?

It validates the 'AI infrastructure' play over pure 'application' plays, signaling that investors believe controlling the underlying data and simulation tooling is the most defensible position in the current technology landscape.

What is the 'strategic capital' mentioned in the funding news?

Strategic capital refers to investment from corporations or entities that have a vested interest in the technology's application (e.g., pharmaceutical giants or large chemical companies), rather than purely financial investors.

Is AI for science funding slowing down globally?

No, while the hype cycle may fluctuate, massive funding rounds like this indicate that strategic capital is still heavily targeting AI applications that promise tangible, high-value returns in physical sciences.

Related News

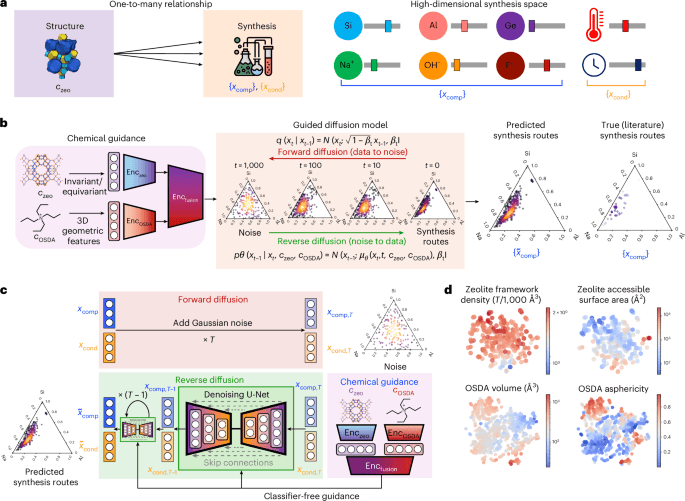

The AI Alchemy Revolution: Why DiffSyn Isn't Just New Science, It's a Threat to Traditional Chemistry Careers

Generative AI like DiffSyn is fundamentally reshaping materials science. Discover the unspoken winners and losers in this new era of chemical discovery.

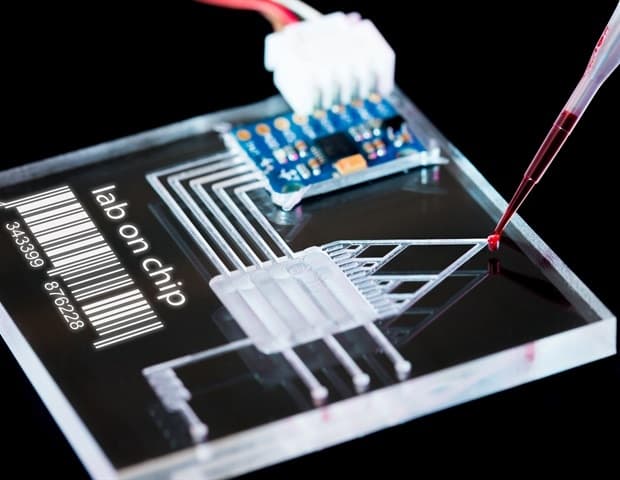

The Hidden Cost of Lab-Grown Organs: Why Simplified Microfluidics Will Bankrupt Traditional Biotech

Digital microfluidic technology is changing 3D cell culture, but the real story is the centralization of pharmaceutical power it enables.

The Hidden Cost of 'AI Saviors': Why Ravender Pal Singh's Math Background Exposes Silicon Valley's Shallow Hype Cycle

The journey from pure mathematics to AI innovation isn't just career progression; it's a warning about AI safety. Unpacking the real stakes.