The Lithium Lie: Why Emerging Battery Tech Will Bankrupt Shipping While Saving No One

The maritime industry's rush toward novel battery solutions masks a brutal reality: the energy transition is an economic Trojan horse, not a green savior.

Key Takeaways

- •The focus on emerging battery tech ignores the massive infrastructure and capital required for industrial-scale maritime adoption.

- •Current battery chemistries cannot match the energy density required for long-haul shipping without severely compromising cargo capacity.

- •The real winners will be those who pivot to transitional fuels or invest in scalable zero-carbon fuels like ammonia, not immediate battery solutions.

- •Over-reliance on new battery chemistries simply shifts geopolitical dependency from oil to critical battery minerals.

The Hook: The Unspoken Truth of Maritime Electrification

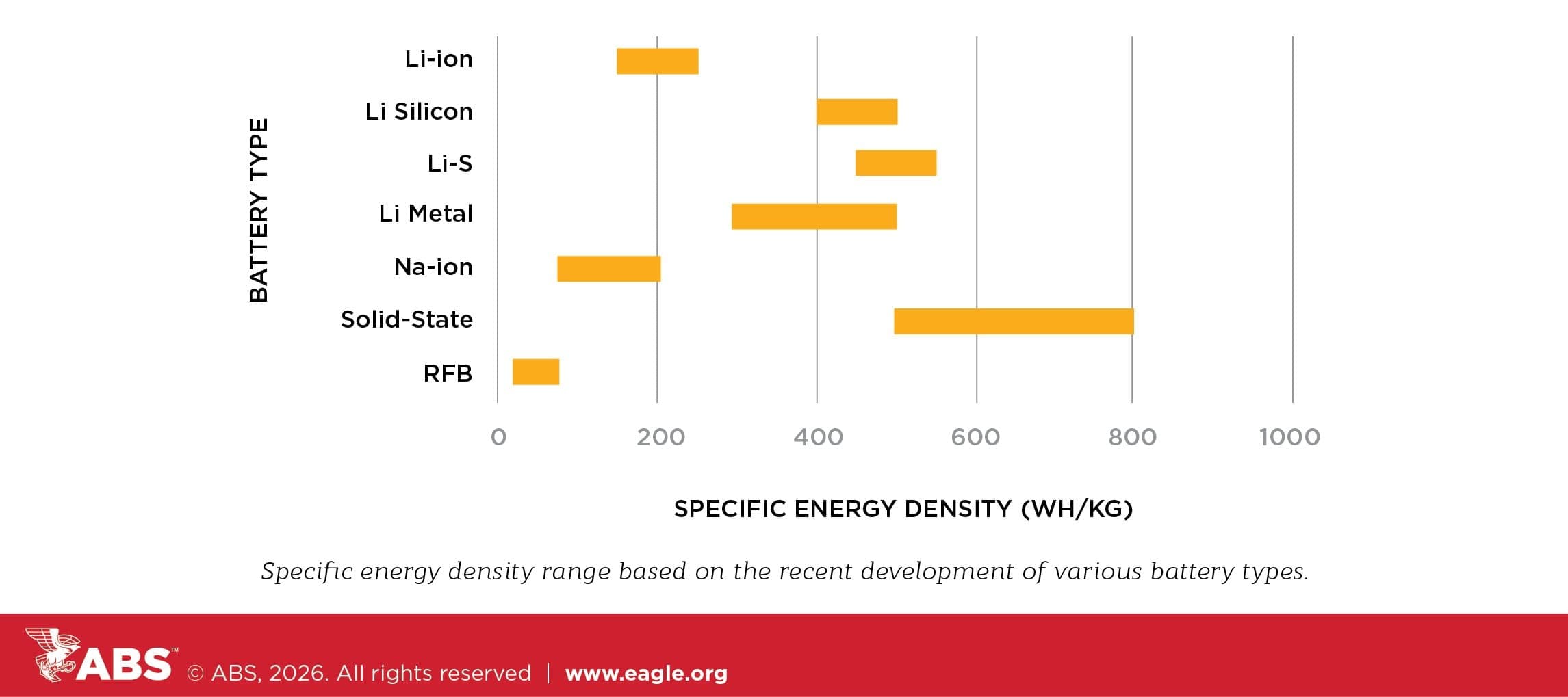

Everyone is talking about emerging battery technologies—solid-state, sodium-ion, flow batteries—as the silver bullet for decarbonizing global shipping. They tout increased energy density and reduced reliance on volatile minerals. This narrative is dangerously incomplete. The real story, buried beneath press releases from tech startups and cautious statements from major carriers, is that the current race for marine energy storage is less about environmental salvation and more about geopolitical maneuvering and technological lock-in. The winners aren't the planet; they are the venture capitalists funding the next speculative bubble.

The 'Meat': Beyond Lithium-Ion's Shadow

The maritime sector, particularly large container vessels, requires staggering amounts of energy. Current lithium-ion solutions, even next-generation variants, struggle mightily with the sheer scale needed for transatlantic voyages. They are heavy, space-consuming, and, critically, present catastrophic safety risks, as evidenced by recurring, spectacular cargo fires involving container ships. The push toward battery technology is therefore a desperate scramble to find a chemistry that can match the energy density of heavy fuel oil without the regulatory headache.

But here’s the catch: every emerging chemistry—whether it’s zinc-air or advanced lithium-sulfur—demands massive, immediate investment in entirely new infrastructure: charging ports, specialized maintenance yards, and redundant grid capacity that simply does not exist. We are witnessing a regulatory mandate forcing an industry reliant on decades of established bunker fuel logistics to pivot overnight to technologies that are, frankly, still laboratory curiosities at scale. The immediate losers are the small and mid-sized operators who cannot afford this capital expenditure.

The 'Why It Matters': The Infrastructure Chasm and Geopolitical Risk

The greatest hidden threat isn't battery performance; it's the bottleneck of raw materials and processing capability. Even if a superior battery chemistry emerges, the global supply chain for critical minerals remains heavily concentrated, often in the hands of geopolitical rivals. Focusing solely on the battery cell ignores the immense environmental and social cost of mining and refining the necessary precursors. This isn't a transition; it's a substitution of one critical resource dependency for another. For example, the supply chain for high-grade nickel or cobalt remains a significant choke point, regardless of whether the final product is LFP or NMC. Analysts suggest supply bottlenecks are inevitable.

Furthermore, the sheer mass of batteries required for long-haul vessels fundamentally compromises cargo capacity. Every ton of battery is a ton of lost revenue. This economic reality means that true, zero-emission, battery-only long-haul shipping remains a financial absurdity until energy density improves by an order of magnitude—something no current emerging battery technology promises in the short term.

Prediction: Where Do We Go From Here?

The industry will fail to meet ambitious 2030 electrification targets for deep-sea shipping. The capital required is too vast, and the technical hurdles too high. Instead, we will see a short-term, cynical pivot: widespread adoption of 'transitional fuels' like LNG or methanol, which offer marginal emissions reductions but use existing infrastructure. Meanwhile, the venture capital pouring into niche battery startups will lead to significant consolidation and failure once the initial hype wears off and the reality of industrial-scale deployment hits. The true winner won't be an electric ship, but the companies that successfully lobby for regulatory extensions allowing them to burn 'cleaner' fossil fuels for another decade while quietly investing in ammonia or hydrogen research—the *real* long-term disruptors.

The current obsession with battery breakthroughs is a distraction from the necessary, but harder, work of overhauling global energy generation to support true, scalable clean fuels. Shipping needs radical fuel sources, not just better storage boxes. The IMO's regulatory framework is pushing for an outcome that physics and economics currently forbid.

Gallery

Frequently Asked Questions

What is the biggest current hurdle for battery technology in large commercial shipping?

The primary hurdle is the energy density requirement. Large container ships need massive amounts of stored energy for long voyages, and current battery solutions are too heavy and bulky, significantly reducing revenue-generating cargo space.

Are solid-state batteries the solution for the maritime sector?

While promising for automotive applications, solid-state batteries are not yet proven at the massive scale and high-power demands of ocean-going vessels. Their adoption timeline for deep-sea shipping remains highly speculative.

Which emerging battery chemistry is most likely to succeed first in maritime?

The industry consensus is leaning toward non-lithium chemistries like advanced flow batteries or metal-air batteries for specific short-sea routes or ferry operations, but for global trade, a radical shift to synthetic fuels (e.g., ammonia) is predicted to occur sooner than full battery adoption.

Related News

The $24 Billion Singapore Gambit: Why Micron's Factory Spells Doom for US Chip Dominance

Micron's massive Singapore investment signals a chilling reality for US tech manufacturing, despite soaring stock prices. The unspoken truth about global semiconductor strategy is laid bare.

The Silent War: Why Russia's New Cancer Tech Isn't About Curing Patients (Yet)

Russian scientists unveil a breakthrough cancer treatment technology. But the real story isn't the science; it's the geopolitical chessboard.

The Digital Oil Grab: Why SLB's AI Play in Libya Signals the End of Traditional Energy Pacts

SLB's deployment of AI in Libya isn't about boosting production; it's about securing future data dominance in volatile energy markets.

DailyWorld Editorial

AI-Assisted, Human-Reviewed

Reviewed By

DailyWorld Editorial