The ACA Tax Credit Time Bomb: Why 2026 Is the Real Healthcare Election Nobody Is Talking About

Forget 2024. The true political battlefield is 2026, hinging on expiring ACA tax credits and the silent crisis of rising healthcare costs.

Key Takeaways

- •The enhanced ACA tax credits expire in 2025, creating a major affordability crisis for millions entering 2026.

- •The real political battleground shifts to 2026 midterms, defined by the looming premium spike.

- •The unspoken truth is that Congress will likely pass a last-minute extension to avoid massive voter backlash.

- •This cycle reveals the ACA's structure is now dependent on perpetual, unplanned subsidy extensions, worsening the national debt.

The Hook: The Silent Crisis Brewing Underneath the Election Noise

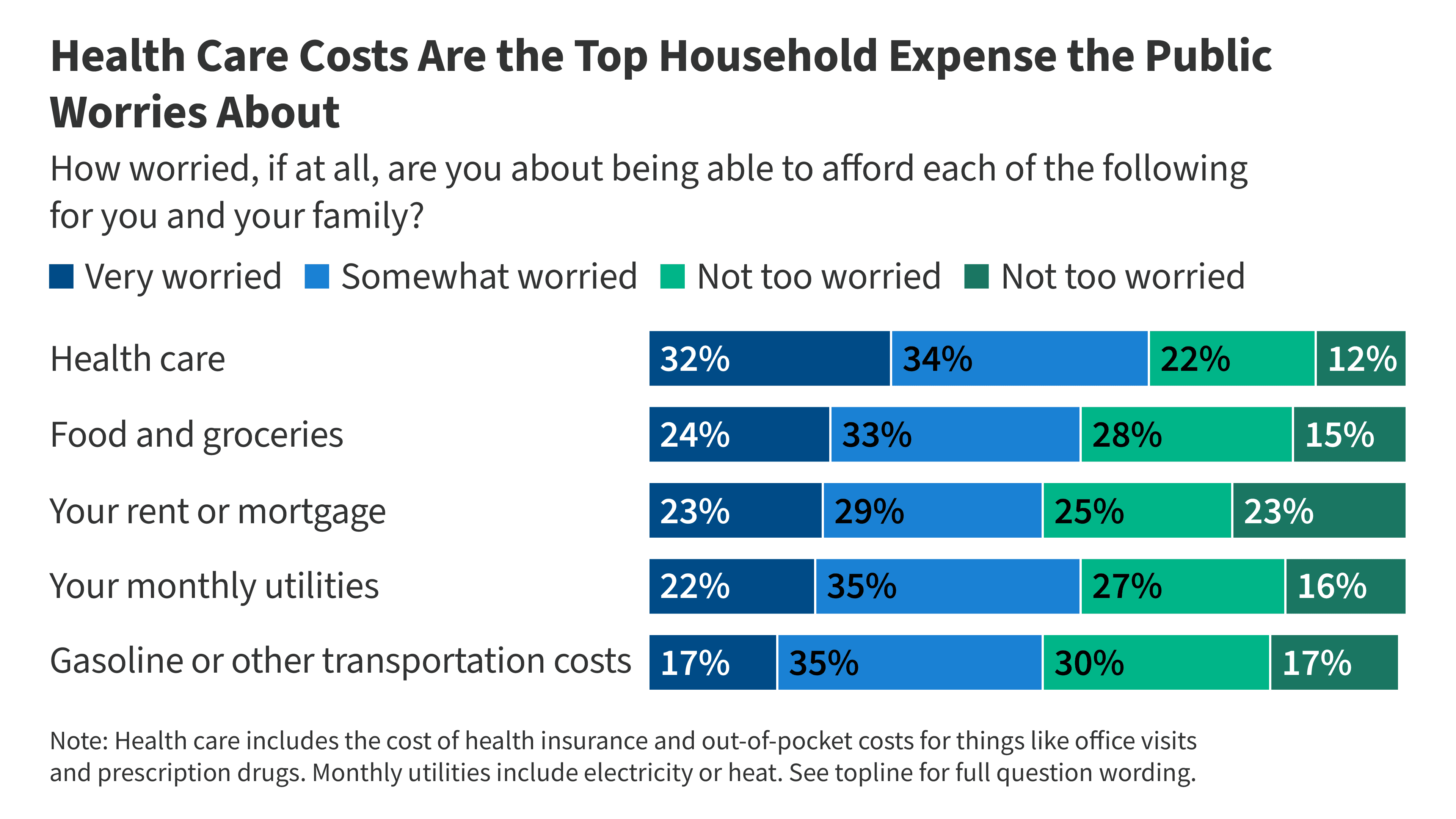

While cable news fixates on the immediate political theater, a far more existential threat to the American household budget is ticking down to zero: the enhanced Affordable Care Act (ACA) tax credits. The KFF Health Tracking Poll confirms what every American already feels in their wallet: healthcare costs are crushing household budgets. But the real story isn't the current pain; it’s the impending fiscal cliff of 2026. This isn't just policy; it’s a ticking time bomb set for the next midterm cycle.

The Meat: Beyond Premiums – The Hidden Subsidy Trap

The current political narrative often centers on the cost of care itself. True, premiums are high. But the immediate, visceral shock awaiting millions is the expiration of the Inflation Reduction Act’s (IRA) enhanced subsidies for ACA marketplace plans. These subsidies artificially suppressed premium costs for millions of middle-income Americans. When they vanish at the end of 2025, the resulting premium spike won't be a marginal increase; for many, it will be unaffordable, forcing a brutal choice between coverage and other necessities. This is the core failure of short-term political fixes: they create long-term dependency followed by inevitable budgetary whiplash.

The data suggests a massive segment of the population is currently enjoying subsidized stability they fundamentally misunderstand. When the enhanced ACA tax credits disappear, those who benefited most—the working and middle class who earn just above the original subsidy thresholds—will face sticker shock that dwarfs inflation concerns. This isn't about expanding coverage; it’s about managing the perception of affordability.

The Why It Matters: The Political Weaponization of 2026

Who really wins here? The political parties are setting up for a spectacular blame game. Democrats will argue Republicans deliberately sabotaged the extension, weaponizing the lapse against the current administration. Republicans will pivot, arguing the underlying healthcare system is fundamentally broken, and these subsidies were merely a costly band-aid masking systemic inflation. The unspoken truth is that both sides are trapped by the ACA’s architecture, which requires constant, expensive legislative patching.

This looming crisis fundamentally shifts the focus for the 2026 midterms. Forget debates over infrastructure; the defining issue will be affordability at the point of sale for insurance. This forces a grim calculation: Will Congress act to extend the subsidies, effectively cementing them as permanent entitlements, or will they allow the cliff to happen, triggering massive political fallout?

Where Do We Go From Here? The Inevitable Extension

My prediction is clear: Congress will pass an extension of the enhanced ACA tax credits in late 2025 or early 2026. Why? Because the political cost of allowing millions of voters to suddenly see their premiums double—especially those who just voted—is catastrophic for the incumbent party. This isn't good governance; it's political self-preservation. The consequence? The federal deficit absorbs another massive, permanent entitlement increase, further entrenching the unsustainable cost structure of U.S. health policy. We are trading short-term stability for long-term fiscal insolvency. The debate over healthcare costs will continue to rage, but the immediate political reality demands a bailout.

For analysis on the underlying cost drivers, examine reports from established organizations like the Kaiser Family Foundation (KFF) on consumer spending habits [https://www.kff.org/health-costs/]. For context on the original ACA structure, consult official government resources [https://www.cms.gov/cciio/resources/data-and-reports]. The geopolitical impact of national spending priorities can be reviewed via reliable economic journals [https://www.nber.org/] (Note: Linking to NBER pages for general context on fiscal policy).

Gallery

Frequently Asked Questions

What exactly are the expiring ACA tax credits?

These are the enhanced premium subsidies introduced under the Inflation Reduction Act (IRA) which made marketplace health insurance significantly cheaper for many middle-income Americans. They are scheduled to expire at the end of 2025.

Why is 2026 considered a critical year for healthcare policy?

Because that is when the enhanced subsidies expire. If Congress does not act, millions of Americans will face massive, sudden increases in their monthly healthcare premiums, turning healthcare affordability into a major electoral issue for the 2026 midterms.

Are healthcare costs the top concern for households right now?

Yes, according to recent KFF tracking polls, healthcare costs consistently rank as one of the top financial burdens for American households, often surpassing concerns about housing or food.

What does 'healthcare costs' typically include for the average family?

This generally encompasses monthly insurance premiums, deductibles, copayments, prescription drug costs, and out-of-pocket spending for necessary medical services.