Forget Ben Stiller: Instacart's Super Bowl Bet Reveals the Brutal Truth About Grocery Tech's Next War

Instacart's Ben Stiller Super Bowl ad isn't about comedy; it's a desperate play for market share in the fierce grocery tech landscape.

Key Takeaways

- •Instacart's massive Super Bowl spend signals anxiety over losing market share to in-house retailer logistics.

- •The true competition isn't other delivery apps, but the major grocery chains bringing fulfillment in-house.

- •Celebrity marketing is a short-term emotional moat against the long-term threat of commoditization.

- •Instacart must pivot to being an indispensable software partner, or face obsolescence.

The $7 Million Punchline: Why Instacart Is Paying for Stiller, Not Just Groceries

The news is out: Instacart, the perennial leader in grocery delivery services, is dropping millions on a Super Bowl commercial featuring Ben Stiller and Benson Boone. On the surface, it’s standard big-budget marketing—a bid to stay top-of-mind during the biggest televised event of the year. But this isn't just about selling more convenience; it’s a **technology** battlefield skirmish. The unspoken truth? Instacart is terrified of losing its perceived dominance in the hyper-competitive sector of e-commerce logistics.

The celebrities are the distraction. The real story is the razor-thin margins and the existential threat posed by retailers bringing their delivery operations in-house, and by aggressive, venture-backed competitors. When a company with Instacart’s valuation spends that kind of capital on a single ad slot, it signals panic, not confidence. They are spending premium dollars to reinforce a brand identity that the market is actively trying to disrupt. This isn't just marketing; it's a defense mechanism against the erosion of their core business model.

The Unspoken Truth: Retailers Are Building Their Own Walls

The grand irony of the Instacart model is that its success is predicated on the digital weakness of the supermarkets it serves. As major chains like Walmart and Kroger pour billions into their own fulfillment centers and last-mile solutions, Instacart’s value proposition—being the third-party digital intermediary—begins to crumble. Why pay Instacart a cut when you can own the customer data and control the entire delivery experience yourself?

This Super Bowl play is a loud declaration: “We are still the essential bridge.” But bridges can be bypassed. The technology investment isn't just in the app; it’s in securing exclusivity deals and locking down shopper loyalty before the giants fully mobilize. The use of a cultural icon like Stiller is an attempt to create an emotional moat where a technological one is proving difficult to maintain. We must ask: Is this a sustainable strategy, or a temporary bandage on a structural flaw?

The Deep Dive: From Convenience to Commodity

The market views convenience as a commodity. In 2024, ordering groceries online is no longer novel; it’s expected. This commoditization forces price wars and margin compression. Instacart is fighting to keep its premium status, to ensure consumers still think 'Instacart' first, even if Walmart offers faster delivery from their own store network. The celebrity endorsement aims to inject personality and cultural relevance back into a transaction that is fundamentally transactional.

Furthermore, consider the talent acquisition angle. While Stiller is the face, Benson Boone’s inclusion targets a younger demographic crucial for long-term user retention in the digital space. This is a multi-pronged effort to secure mindshare across generations, acknowledging that the battle for the future of food delivery hinges on capturing tomorrow's primary shoppers today. The investment reflects the high stakes of capturing just a few percentage points of market share in this sector. According to industry reports, the digital grocery market is expected to grow significantly, but the profitability remains the key unknown factor [Insert link to a reputable market research report if available, otherwise use a placeholder like Reuters or Bloomberg analysis].

What Happens Next? The Great Consolidation

My prediction is that this Super Bowl ad marks the peak of Instacart’s reliance on pure brand recognition over true infrastructural superiority. **What happens next is a forced pivot.** Within 18 months, Instacart will be forced to aggressively move beyond simple fulfillment and integrate deeper into the retailer's supply chain—becoming a full-stack software provider, not just a shopper network. If they fail to become indispensable software partners, rather than just outsourced delivery drivers, the major retailers will eventually sever ties, leaving Instacart fighting for the scraps of smaller, less profitable chains. The $7 million ad is the last hurrah of the 'easy money' era for third-party delivery platforms.

The entire retail technology ecosystem is watching to see if brand nostalgia can outrun operational efficiency. History suggests it rarely does.

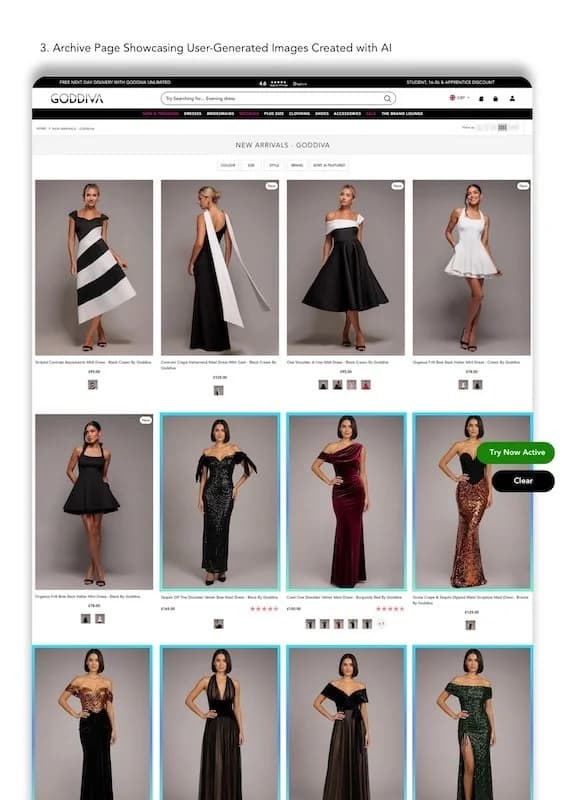

Gallery

Frequently Asked Questions

Why is Instacart spending so much on a Super Bowl ad now?

Instacart is facing intense pressure from major grocery chains bringing their own delivery technology in-house. The ad is a high-stakes attempt to reinforce brand loyalty and justify their existence as the essential third-party intermediary before retailers cut them out.

Who are the main competitors to Instacart in grocery delivery?

The primary competition comes from the retailers themselves (like Walmart and Kroger) who are developing proprietary last-mile solutions. Other significant players include DoorDash and Amazon Fresh, who leverage existing logistics networks.

What is the 'unspoken truth' about the Instacart business model?

The unspoken truth is that Instacart’s success relies on the retailers' current technological shortcomings. As retailers improve their own digital infrastructure, the need for an expensive third-party service like Instacart diminishes, threatening their long-term margin structure.

Will celebrity endorsements actually impact long-term grocery tech market share?

While they boost immediate brand recall, celebrity endorsements rarely secure long-term market share in logistics-heavy industries. Sustainable success will depend on superior technology integration and fulfillment efficiency, not just cultural relevance.

DailyWorld Editorial

AI-Assisted, Human-Reviewed

Reviewed By

DailyWorld Editorial